Home

Visit our Daily Videos page and get trade ideas and expert market commentary from Dan Passarelli

Visit our Trading Education Webinars page and learn trading techniques from the trading world's top traders

Trading Education Articles

Set Profit Targets and Define Risk Using ATR

John Seguin, Market Taker Mentoring

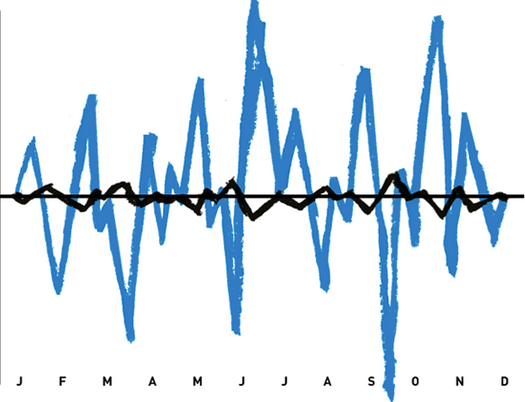

Around the end of every year, I like to do statistical analysis to prepare for the first quarter of the coming year. The most important spreadsheet I generate consists of recent average ranges and benchmark or long-term ranges for stocks, ETFs and commodities. Most charting platforms have the ATR (Average True Range) indicator. ATRs are valuable because they improve our ability to set profit targets and define risk over various time frames. Furthermore, a comparison of near-term ranges against long-term benchmarks can be used to determine if volatility is rich or cheap. In addition, ATR can be used to gauge if a market is ready to begin a trend or identify when a market is overbought/oversold. [more]

Don’t Forget to Add Up Option Greeks

John Kmiecik, Market Taker Mentoring

Understanding the option greeks is completely critical to an option trader. Knowing what greeks are, positive or negative, and how changes will affect your position is essential. That said, many option traders I talk to (just this past week, in fact), forget that the greeks do add up the bigger the contract size is. [more]

Understanding the Secret to Stochastics

John Seguin, Market Taker Mentoring

There is a myth that Stochastics and RSI (Relative Strength Index) are both used to determine whether a market has reached overbought/oversold status, thus indicating when a trend is near an end or likely to reverse direction. However, RSI is more appropriate for gauging strength of trend. An RSI reading above 50 indicates bullish momentum, and a reading below typically favors short positions. While Stochastics are suited for timing market turns or reversals, the secret is to use them with divergence. [more]

How Straddles and Strangles Work

John Kmiecik, Market Taker Mentoring

Straddles and strangles are strategies option traders can use when they think a move in the underlying is imminent, but the direction is uncertain. Sounds like a can’t-lose plan, right? Well, obviously, if it were that easy, we would all be trading them, all the time. Let’s take a closer look. [more]

Check Your List Before Entering a Trade

John Seguin, Market Taker Mentoring

To be competitive back when I was a broker, I had to adapt to different conditions and client requests. This inspired me to develop a set of rules for trading equities, treasuries, precious metals, energies, currencies and grains. These categories are often connected either directly or inversely. Early in my career I researched many technical tools and indicators. However, I soon realized that fundamentals move markets and technicals are useful when event risk is low. [more]

Option Trading and Life Are Not Perfect

John Kmiecik, Market Taker Mentoring

When it comes to trading, we try to put the odds on our side to create a better opportunity to extract money from the market. Many traders do this by using technical analysis to gain an edge. Here is a brief reminder that you need to keep trying to put the odds on your side even though it may not always work out. [more]

Identifying Price Patterns

John Seguin, Market Taker Mentoring

Before computers were used for charting on the CBOT trading floor, books were published weekly with day and week bar charts for all the futures markets. On the exchange trading floor, many traders used handmade graphs to track short-term price action with intraday bars using open, high, low and close (OHLC). Some used the point & figure technique and eventually candlesticks became popular. Charting or technical analysis involves mapping and organizing prices to identify patterns. [more]

Hard Profit Taking Option Orders

John Kmiecik, Market Taker Mentoring

Here is a topic I cover daily when it comes to options trading. It is so important that I cannot go a day without bringing it up several times in MTM’s Group Coaching class or with students in a one-on-one environment. The topic is always having a hard profit taking target when you have a position on. [more]

Define Support and Resistance Zones

John Seguin, Market Taker Mentoring

All traders strive to buy when prices are cheap and sell when they are rich. Bulls or buyers prefer the long side and search for support areas, while bears or sellers favor the short side and seek out resistance areas. The choice to be a bull or bear varies for all traders. To determine support and resistance zones traders use charts that reveal the history of price action. An ideal trade occurs when we enter a trend early and exit when it is exhausted. Buy low, sell high. Traders endeavor to sell as a trend is peaking and buy when prices are cheap. Ideal entry and exit are desired, but perfect timing is illusive. [more]

Theta Can Be Friends with Delta

John Kmiecik, Market Taker Mentoring

Long calendars happen to be my favorite time spread. For the most part, I like to sell the current week’s expiration and buy the following week’s expiration. If you are not familiar with them, long calendars consist of selling a call or put and buying another call or put with the same strike but a longer expiration. I like to initiate them early in the week, say, Monday or Tuesday. Positive theta is the main source of potential income for this position, but I like to look at it a little differently. [more]

How to Handle Low-Volume Pockets

John Seguin, Market Taker Mentoring

As a futures broker, I had many clients who used automated or algorithmic systems for trading management. These trading systems are mainly developed to capture vertical moves. When a buy/sell signal is triggered it frequently has a domino effect that causes prices to move rapidly. The most common bullish breakouts occur when the top of a channel (flag) or pennant (triangle) is violated. A bearish trend often begins when the bottom of a flag or pennant is breached. The type of candlestick at the onset of a breakout can be revealing as well. Candles with full bodies and small wicks are an indication of dominance. Thus, a full-bodied candle passing through a trendline is often the catalyst for an above average vertical move. When a market breaks into a trend it is often fast and furious leaving behind gaps or low-volume pockets known as volume voids. [more]

Focus on the Appropriate Moving Averages

John Seguin, Market Taker Mentoring

In my experience futures traders tend to be short-term oriented, opting to hold trades for hours to a few days. Equity market traders tend to trade for longer time frames. One reason futures traders are more speculative may be due to margin requirements, which are often a drain on smaller trading accounts. As a result, they often flatten all positions before the close each day. Most of my trades in the futures market are intended to be speculative, meaning I will be out of the position within 24 hours or even by the end of a trading session. Generally, stock market traders and investors plan to hang onto trades for days and often weeks or more. Thus, it is important to choose technical indicators that are appropriate to your time frame. [more]

The Market Is Resilient

John Kmiecik, Market Taker Mentoring

At the time of this writing, the Federal Reserve had cut interest rates by half a point just a couple of hours ago. As usual, the market whipped higher and lower before settling lower on the session. But aside from that day’s activity, the S&P 500 has been on quite the move higher since last November. And if it can break some current resistance, it may continue to thrive. [more]

Avoid Poor Trade Location

John Seguin, Market Taker Mentoring

All traders endeavor to catch a trend early and ride it late. To accomplish that requires incredible timing on both entry and exit. Some trends end slowly after shifting to neutral. Others end abruptly after moving too far, too fast, otherwise known as reaching overbought/oversold (OB/OS) status. Lately, volatility has been quite high as there have been big swings in many markets. Getting long when a market is overbought or short when it is oversold usually does not pay. It is known as poor trade location. [more]

It’s All About Experience as an Option Trader

John Kmiecik, Market Taker Mentoring

Learning how to trade options effectively takes time. And let’s face it, for many option traders real, ongoing success never comes to fruition. Most traders cannot extract money from the market on a consistent basis because, well, it’s hard to do so. So why do we try? We try because it is rewarding to be a successful option trader either part time or full time. Keep in mind, though, that the one thing that cannot be rushed in your education process is the experience you receive from trading. [more]

The Shift in Fundamental Focus: Inflation vs. Recession

John Seguin, Market Taker Mentoring

I make it a point during every MTM Monday Morning Meeting to highlight the connection between the financial and energy markets. Central banks set interest rate policies, which have a direct impact on bond prices and currencies. Foreign exchange rates influence stocks, metals and energy, as well as many other commodities. A mixture of all these markets and earnings completes the chain of major market movements. [more]

Option Trades Near the Close

John Kmiecik, Market Taker Mentoring

There’s no denying that this market is extremely volatile. It’s a difficult environment for swing traders and may be more suited to day traders. There is never a guarantee when the market closes that it will open higher or lower the next session, even if it’s a bullish or bearish close. We can, however, observe how the market closes to put the odds on our side, especially if we’re looking for a directional opportunity. [more]

Fundamental Shift and Volume Voids

John Seguin, Market Taker Mentoring

Recently there was a fundamental shift in markets. For a couple of years positive economic news was bearish for both stocks and bonds. Weak data was bullish for those sectors because it might make the Fed more likely to lower interest rates. Recently the Fed shifted from focusing on inflation to paying more attention to employment data. This is a fundamental shift from price pressures to job reports. [more]

Be Patient When Markets Are Volatile

John Kmiecik, Market Taker Mentoring

The markets have remained very volatile over the past several weeks. At the time of this writing, the S&P 500 had fallen over 2.3% in a day. It has been a bumpy road over the past few months for sure, and most likely it will continue to be for several more. Even though the markets have been uncertain, there is something you should be certain about and that is to be patient and wait for opportunities. [more]

Look to the Pros for a Trading Edge

John Seguin, Market Taker Mentoring

Spend time with a broker or pit trader from the era when all trades were executed in a trading pit at an exchange, and you will learn how to decipher information provided in an open outcry environment. Pits were created to facilitate trade. To an untrained eye a trading pit looks like a mess of angry, aggressive people wearing crazy-colored jackets. [more]

Your Option Trading Day in a Nutshell

John Kmiecik, Market Taker Mentoring

Every so often, I like to remind option traders about things they need to think about before, during and after their trading day. Clearly, there are a lot of moving parts in making that decision, but there are also more than a few constants. Here are some factors I consider each trading day. [more]

Best Uses of Bollinger Bands

John Seguin, Market Taker Mentoring

I knew little about markets or economics when I began my career at the Chicago Board of Trade almost 40 years ago. Early in my career I started a journal that contains a multitude of lessons learned from colleagues, books and empirical research from the trading pits at the CBOT and CME. I also recorded my many mistakes because I learn the most from them. My “trading toolbox” is packed with the best parts of many disciplines. Bollinger Bands can be used for trend and counter trading strategies. Here are some of my favorite Bollinger Band tips. [more]

Take Advantage of a Bullish Base

John Kmiecik, Market Taker Mentoring

We frequently talk about bullish bases in MTM’s Group Coaching class, especially with the market moving higher for much of the year so far. But what does a bullish base look like and how can we use it for a potential bullish entry? Here’s a brief explanation of what a bullish base is and what to look for. [more]

Use Chart Techniques to Trade Like a Pro

John Seguin, Market Taker Mentoring

As an educator I have made assumptions that new traders already have a good understanding of technicals and fundamentals. The more I teach the more I realize most traders have not experienced trading pits and the valuable lessons we were privy to in that environment. In addition, I learned many lessons in fundamentals by watching the impact economic reports had on price action.

Looking back, it was a privilege to participate in the auction process in its most basic form, a trading pit. Professional traders tend to execute large trades during the highest volume periods. Generally, liquidity is highest near the open and close of a trading day. Thus, the strongest directional signals come in the first hour and the last 30 minutes of the trading session. The direction the market moves during those times reveals which direction the professional traders favor. [more]

Look For Pullbacks in NVDA

John Kmiecik, Market Taker Mentoring

Not sure if you have heard about a little, old stock called NVDIA (NVDA). It has been the talk of the market for several weeks now. The stock has moved vigorously higher for quite some time, especially since the beginning of this year. Then the company announced a 10 for 1 stock split, which pushed its stock even higher before and again after the split. But as we know, stocks do not go higher forever, and recently the stock pulled back. As an option trader, this is a chance to take advantage of. [more]

Versatility of Average True Range

John Seguin, Market Taker Mentoring

For decades I have published futures updates for treasuries, forex, metals, energies, equities indexes and grains. To do this daily task I have a routine for each sector. Aside from examining fundamental data, I use a few technical indicators. The most practical indicator I employ is Average True Range (ATR). This versatile gauge can be used to set support/resistance areas, profit targets and risk. By comparing ATR from the near term against a long-term benchmark this tool may also be used to determine if a market is overbought/oversold or wound too tight. [more]

Interpreting Technical Nuances and Market Reactions

John Seguin, Market Taker Mentoring

I spent nearly two decades on trading floors in Chicago. After the markets closed many traders and brokers unwound from stressful days in local pubs and restaurants. In these post-market “meetings” we talked about family, sports and other non-trading topics, but mostly we discussed the day’s events and market movement. My friends and colleagues shared knowledge that shaped their trading style. Our discussions frequently included favorite patterns, technical nuances and reactions to fundamental data. One friend liked to countertrade a market if it moved 50% of an average day from the opening price. Another trader always bought or sold the 30-year bond every time it hit the number 10, because for some reason the market often reversed when that price traded. [more]

Smart Traders Record Their Trades

John Kmiecik, Market Taker Mentoring

Option trading is like the game of golf. You can never be perfect at it, but you can always get better. As I like to say, “the one thing I cannot teach as an option trader is experience.” The obvious question, then, is how does one gain that experience. There are two ways, and one is obvious: by trading. The other is by reviewing your trades, and the best way to do that is to record them. [more]

Trade With Passion and a Plan

John Seguin, Market Taker Mentoring

Since I was a kid, I have been passionate about sports; baseball and golf are my favorites. I learned that devotion to practice and preparation returned rewards. Any endeavor you choose, make it your passion. A trader should embrace the same approach. Obsess to be the best. I have taken my passion and competitive nature for sports and applied it to markets. If you want to compete with professionals, practice like one. [more]

Watch How a Stock Closes

John Kmiecik, Market Taker Mentoring

Getting an edge using technical analysis is crucial when it comes to trading. If you hold a position overnight, there is never a guarantee how the market will open the next session. If only we knew, right? Trading would be a whole lot easier and less nerve-racking. There is something I have found, however, that helps tremendously and that is watching how a stock closes on the day. [more]

Finding the Ideal Trade Location

John Seguin, Market Taker Mentoring

Perfect timing when entering and exiting trades is every trader’s dream. Early recognition of a breakout or onset of a trend is key to attaining the ideal trade location. Early entry not only increases profit potential, but it also reduces risk. It is vital to employ short-term or intraday direction indicators that will enhance the timing of a trade. [more]

Delta Is Lead Dog for Vertical Credits

John Kmiecik, Market Taker Mentoring

I model out several vertical credit spreads every day in MTM’s Group Coaching class. And every day I talk about delta being the most important greek, in my opinion, for vertical credits. Most option traders associate credit spreads as mostly a positive theta trade. I am going to show you why I believe delta is usually the bigger factor. [more]

Dealing With Market Pace Problems

John Seguin, Market Taker Mentoring

Given the recent extraordinary moves in interest rates and equity markets I figure it is time to introduce my favorite velocity indicators.

A trader’s goal is to catch trends early and squeeze as much profit as possible out of them. To accomplish this requires incredible timing on both entry and exit. Some trends end slowly after shifting to neutral. Others end abruptly after moving too far, too fast, otherwise known as reaching overbought/oversold (OB/OS) status. Therefore, traders need to choose a market speedometer to deal with pace problems. [more]

Option Trading Is ‘Almost’ Always a Trade-Off

John Kmiecik, Market Taker Mentoring

When I talk about options, which is quite often, I like to say that everything in options is a trade-off. As I tell my students, if you give up this, you get that in return and vice versa. If you have a better risk/reward trade, the probability of a profit is lessened and vice versa. But lately I have found an exception or two, especially when it comes to time spreads. [more]

What Has a Better Chance of Happening?

John Kmiecik, Market Taker Mentoring

I ask traders this all the time when I am teaching technical analysis: “When you look at a chart, what has a better chance of happening?” In fact, we should ask ourselves this question in many situations that do not involve trading, but that is a discussion for another time. As option traders, we try to put the odds on our side through various means to gain an edge, and one of the most important is technical analysis.[more]

Returning to the Proverbial Option Trading Well

John Kmiecik, Martket Taker Mentoring

I am often asked, “When I have a profitable trade and the setup still looks good, should I take the trade again?” The answer is, “Absolutely! Why not?” If the setup is still there and you feel the same about the trade and market, it totally makes sense. [more]

How to Use Daily Pivot Prices

John Seguin, Market Taker Mentoring

Pivotal prices are used in various ways. Some traders use them to identify support and resistance areas or entry and exit zones, or they may be used to define momentum. There are more than a few ways to determine daily pivot points. The most popular requires some basic math using the average of the high, low and close, and sometimes the open price is included in the equation. On the ensuing day, trading above the pivot point is considered bullish, while trading below the pivot point implies bearish sentiment. [more]

Time to Tighten Up Your Option Management

John Kmiecik, Market Taker Mentoring

Volatility in the market has become the norm…this first week of March 2024 in particular as Federal Reserve Chair Jerome Powell testifies in front of Congress for two days. There have been some sizable market swings. Should you manage your option trades differently in a market like this? You have to decide that for yourself, but it might be a good idea to explore your options (no pun intended). [more]

Improve Trade Entry with Timing Tools

John Seguin, Market Taker Mentoring

Late entry for a position can be costly in that it increases risk and decreases profit potential. In previous articles I introduced some of the tools from my “trader toolbox.” Here I’ll share some of my favorite indicators for improving entry with timing tools. [more]

The Market Does Not Always Go Up

John Kmiecik, Market Taker Mentoring

The market has been on a pretty big bullish run over the past couple of months. As a trader, how do you not focus on more bullish than bearish trades, right? The market is due to pull back at some point, of course. Still, there will always be traders who focus only on bullish trades (yes, even when the market is heading south). Let’s look at why that may be the case. [more]

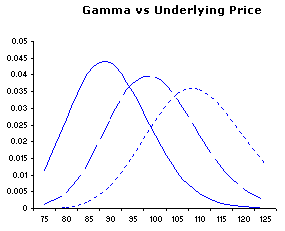

Let’s Chat About Option Vega

John Kmiecik, Market Taker Mentoring

Implied volatility or the lack of it has been a hot topic for option traders over the past several months. If you are unfamiliar with IV and/or option vega, here is a brief explanation to get you up to speed.

Option Vega

Vega measures the impact implied volatility (IV) has on option premiums. Keeping it simple, for every 1% change in IV, vega will change the premium by that amount. If IV rises 1%, option premium will rise by the amount of vega. [more]

Note Patterns to Identify Market Trend Changes

John Seguin, Market Taker Mentoring

Markets tend to shift to neutral at the end of trends. Furthermore, there are often subtle changes in momentum before reversing direction. Good traders have a knack for identifying the start of a trend or the end of one. There are a few patterns that are common at the end of a move. [more]

Theta Can Help Your Unwanted Delta

John Kmiecik, Market Taker Mentoring

If you have attended MTM’s Group Coaching class, you probably know how much I love time spreads. In fact, I even have a T-shirt I like to wear that says so. Calendars happen to be my favorite time spread, usually of the short-term variety. If you are not familiar with them, long calendars consist of selling a call or put and buying another call or put with the same strike but a longer expiration. For me that usually means selling the current week’s expiration and buying the next if there are weekly options available. I like to initiate them early in the week. Positive theta is the main source of potential income for this position, but I like to look at it a little differently. [more]

Partner Stochastics with Divergence

John Seguin, Market Taker Mentoring

The myth is that Stochastics and RSI (Relative Strength Index) are both used to determine whether a market has reached overbought/oversold status, thus indicating when a trend is near an end or likely to reverse direction. However, RSI is more appropriate for gauging strength of trend. An RSI reading above 50 indicates bullish momentum and a reading below typically favors short positions. Meanwhile, a Stochastic is a more reliable indicator for identifying market turns, especially when partnered with divergence. [more]

Option Greed Is Not Good

John Kmiecik, Market Taker Mentoring

Although “greed is good” is a famous line from a movie, in real life as an option trader greed is not good. One of the biggest regrets and mistakes I hear from option traders is that they are going for profit targets that are too big, especially for debit positions. Consider this a quick reminder to decrease your overly high expectations. [more]

Choosing the Right Trading Tools

John Seguin, Market Taker Mentoring

No matter which career you choose, they all require tools to be successful. Most tools are tangible, while others are psychological, mathematical and even spiritual. As a trader my tangible tool is a chart. There is math in my favorite market indicators, and the indicators illustrate psychological and sociological behavior. As for the spiritual part, it is the euphoric feeling a trader gets when all the hard work and analysis pay off as a lucrative trade that involves minimal risk. [more]

A Top Tool for Traders

John Seguin, Market Taker Mentoring

Typically, markets are quiet during the last two weeks of the year with below average ranges and volume. It allows me the time to do research in preparation for the upcoming new year. I enjoy statistical analysis because each clue is a piece of the puzzle traders try to solve every day. Range length is one of my top tools for creating strategies. [more]

How to Improve Entry and Exit Prices

John Seguin, Market Taker Mentoring

Traders strive to sell at extreme highs and buy near the low of a trend. Setting precise entry and exit levels is a difficult task, yet a skill that can be honed. In this business a long position or buy level is recognized as support and a short position or selling price is known as resistance. One of the ways to improve entry and exit is to look left on your charts to get a history lesson. [more]

Take Some Time Off for the Holidays

John Kmiecik, Market Taker Mentoring

It’s time for my annual holiday reminder (although you’ll hear me say it at other times of the year as well) about the importance of taking time off as a trader and even as an investor. It is just healthy to do so. The holidays are crazy for most people, and many would say the market has been crazy too. But even if things are not so crazy market or holiday-wise, time off for a trader is imperative. [more]

An Alternative to Selling Option Premium

John Kmiecik, Market Taker Mentoring

We have talked many times about the draw of selling out-of-the-money (OTM) vertical credit spreads for an option trader. Putting it bluntly, the odds are on your side to make money. But guess what? The risk/reward is not so sweet. If you have looked at implied volatility (IV) levels and option prices recently, you know they have been very low. And some would consider option prices cheap. I’m not trying to talk you out of taking credit spreads. Instead, I’m suggesting you consider vertical debits when there is a directional bias and option prices are low. [more]

How to Use Indicators in Your Trades

John Seguin, Market Taker Mentoring

There are no trading tools, indicators or patterns that pay off every time. However, they all have their moments. Good traders know when probabilities have shifted to favor a trend-style trading strategy or a neutral (countertrade) approach. There are two essential technical indicators that traders utilize to create strategy. The vertical indicator measures range (height) over various time frames. This indicator measures the speed of a trend. The horizontal indicator measures width during consolidation phases. Width or time at price reveal fair value areas. Using logic and these two dimensions is vital when choosing to employ directional or neutral option strategies. [more]

Avoiding Stress as an Options Trader

John Kmiecik, Market Taker Mentoring

It is impossible to avoid all stress. Unfortunately, it is just a part of life. Obviously, as any doctor or health professional will tell you, you should avoid stress and stressful situations as much as you can. Naturally, that is easier said than done for most. So, what can we do to avoid stress? I have a few thoughts for option traders that can apply to everyday life too. [more]

Reversals and Overbought/Oversold Markets

John Seguin, Market Taker Mentoring

Over the past two weeks we have seen far above average vertical moves in stocks, bonds, forex, precious metals and crude oil. So, to be pertinent, I thought it best to introduce several ways to identify change in trend after a market has moved too far, too fast. This is otherwise known as reaching overbought/oversold (OB/OS) status. [more]

Are You Making Time for Theta?

John Kmiecik, Market Taker Mentoring

When most people think about buying equity options, they think of time and expiration. Of course, options are expiring assets. Of all the option greeks, theta may be the easiest to comprehend on the surface. But truly understanding how it works is another story. Let’s take a look at the definition of option theta and how it may change your thought process when it comes to implementing and managing trades. [more]

Pro Traders Commit to Routines

John Seguin, Market Taker Mentoring

I have always been passionate about sports; baseball was my favorite. Now in my 60s my abilities limit me to playing golf, not running down fly balls. One thing has never changed, however. I love to practice and hone my craft no matter which sport or project I am working on. My desire to be the best motivated me to develop routines. These days I apply passion and competitive nature to trading markets. If you want to compete with pro traders practice like one. Practice builds instinct. [more]

Don’t Roll Your Short Option Too Soon

John Kmiecik, Market Taker Mentoring

There are lots of mistakes you can make as an option trader, let alone as a human being. Let’s be honest, some just can’t be helped. But you can prevent rolling a short option too soon if you practice a little patience. Let’s take a look at what I mean by that. [more]

Taking Profits and Trailing Stops Using Targets

John Seguin, Market Taker Mentoring

A trader’s goal is to enter a position early in a trend and ride that position until an objective or target price is met. Catching a trend is difficult enough; squeezing the last dollar out of a trade is even harder. Stop loss orders are used to set risk. As another option they can also be used to manage profitable trades with an order type known as a “trailing stop.” [more]

Bear Call Trades on SPY

John Kmiecik, Market Taker Mentoring

I have this saying when it comes to technical analysis that goes like this: “What has a better chance of happening”? What I mean is, based on support and/or resistance, what does the underlying have a better chance of doing? Now let’s be clear, there is not always a definitive answer to that question. But many times there is, and an option trader can take advantage of those odds. Let’s start with support and resistance. [more]

Moving Averages vs. Pivot Points

John Seguin, Market Taker Mentoring

Moving averages are the most popular directional gauges. They are typically the first technical indicator in the novice trader’s toolbox. Many professional traders rely on them as well. Typically, the directional signals come when a short-term MA crosses a long-term MA. The problem with this method is that [more]

Are You Guessing Too Much as an Option Trader?

John Kmiecik, Market Taker Mentoring

If we are being honest, there is a lot of guessing when it comes to trading. As technical traders, our goal is to put the odds on our side. We know that if we do, we have a better chance of being successful. That said, there is still some luck involved pertaining to how the market moves and how the underlying position is affected. But sometimes traders can’t control themselves and are biased. [more]

How to Recognize Changes Indicating a Shift in Trend

John Seguin, Market Taker Mentoring

Markets tend to shift to neutral at the end of trends. Furthermore, there are often subtle changes in momentum before reversing direction. Good traders have a knack for identifying the start of a trend or the end of one. There are a few patterns that are common at the end of a move. [more]

That Voice Inside Your Head

John Kmiecik, Market Taker Mentoring

We all have sayings we love to repeat to ourselves. And when we say them out loud, let’s face it, it can be irritating to others. That is actually my goal when I repeat certain sayings to my students. I want them to be annoyed with me and finally listen and adhere to what I am saying. My one-on-one and group coaching students will tell me they hear my voice in their heads. I love it! [more]

Option Vega Can Be Tricky

John Kmiecik, Market Taker Mentoring

The market can be very volatile, and if you have traded at all over the past several months you know that very well. As an option trader, you probably are and definitely need to be familiar with how implied volatility changes can affect option prices and the way you think about different strategies. Let’s look at something I covered in MTM’s Group Coaching class on one of those volatile days when the market was all over the place. [more]

Use Stochastics for Reversals, RSI for Momentum

John Seguin, Market Taker Mentoring

The myth is that Stochastics and RSI (Relative Strength Index) are both used to determine whether a market has reached overbought/oversold status, thus indicating when a trend is near an end or likely to reverse direction. However, RSI is more appropriate for gauging strength of trend. An RSI reading above 50 indicates bullish momentum and a reading below typically favors short positions, while a Stochastic is a more reliable indicator for identifying market turns. [more]

A Look at Technical Analysis Basics

John Seguin, Market Taker Mentoring

Technical analysis is using history to forecast the onset of a trend or determine when a trend is nearing an end. Technical tools and indicators are also used to improve entry and exit levels. Fundamentals, or the forces of supply and demand, earnings, inflation, weather, etc., move markets. Technicals are most useful when fundamental data are scarce. [more]

My Checklist for Entering Trades

John Seguin, Market Taker Mentoring

When I started my analytic career as a technician, I soon realized a fundamental view of the markets is just as if not more important than charting techniques. This inspired me to develop a set of rules for trading equities, treasuries, precious metals, energies and currencies because these markets are usually connected. [more]

A Look at IV Levels Around Earnings

John Kmiecik, Market Taker Mentoring

If you don’t trade options over earnings announcements, you may have not noticed what happens to implied volatility (IV) levels. Usually an expected volatility event like earnings increases the price of options. In other words, when implied volatility increases, so do option prices. That can give an option trader an edge, but that edge is based on a volatility event. Let’s take a quick look below at a recent example. [more]

Good Timing Reduces Risk and Increases Profit Potential

John Seguin, Market Taker Mentoring

Identifying when the odds are high for a trend to commence reduces risk while increasing profit potential. Timing this phenomenon requires a breakout strategy. Entry at the beginning of a sharp vertical move (trend) is the goal.[more]

Use Market Tendencies to Your Advantage

John Seguin, Market Taker Mentoring

I spent many years on trading floors, which led to many hours in pubs and restaurants talking about markets with professional traders. In these post market “meetings” we talked about family and sports, among other things, but mostly we discussed the day’s events and market tendencies. My friends and colleagues shared knowledge that shaped their trading style. Our discussions frequently included favorite patterns, technical nuances and reactions to fundamental data. [more]

Uncover Clues That End or Reverse Trends

John Seguin, Market Taker Mentoring

Markets many times shift to neutral at the end or reversal of a trend. Furthermore, there are often subtle changes in momentum before reversing direction. Good traders have a knack for identifying the start of a trend or the end of one. There are a few patterns that are common at the end of a move. [more]

Basic Technicals for Choosing Trade Type

John Seguin, Market Taker Mentoring

Technical analysis is using history to forecast the onset of a trend or determine when a trend is nearing an end. Technical tools and indicators are also used to improve entry and exit levels. Fundamentals, or the forces of supply and demand, earnings, inflation, weather, etc., move markets. Technicals are most useful when fundamental data are scarce. [more]

Get Friendly in Your Trading

John Kmiecik, Market Taker Mentoring

Trading can be a very lonely undertaking. As a retail trader, you may sometimes feel like you are on an island because you have to make all the decisions yourself. Obviously, there are good things about that too. You are your own boss…hooray! But this mentality feeds into why extracting money from the market can be so difficult. When you are on your own with trading, and with anything in life actually, the psychological aspects can rear their ugly head. There is a simple solution that cannot guarantee your success but can definitely help: Find a friend. [more]

The Benefits of Bollinger Bands

John Seguin, Market Taker Mentoring

In previous articles I have referred to my “toolbox.” It is a journal I started writing in the beginning of my career 30-plus years ago. I recorded my many mistakes because I learn the most from them. But it also comprises lessons learned from colleagues, books and empirical research from the trading pits in Chicago. My toolbox is filled with the best parts of many disciplines. In this article I will share my favorite Bollinger Bands tips. Bollinger Bands can be used for trend and counter trading strategies. [more]

Think Like a Pro to Trade Like One

John Seguin, Market Taker Mentoring

Spend time with a broker or pit trader from the era when all trades were executed by brokers in trading pits at exchanges and you will learn about open outcry and the information it provides. Pits were created to facilitate trade. To an untrained eye a trading pit looks like a ring filled with angry, aggressive people wearing badges on various colored jackets. But for a seasoned observer a trading pit reveals incredible amounts of information not available on screens or trading platforms. Professional traders monitor order flow. Pro traders use a combination of market-generated information (technicals) and fundamentals (supply/demand or earnings) to define and refine strategies. [more]

Volatility and Vertical Debit Spreads

John Kmiecik, Market Taker Mentoring

Let’s start with something simple that most option traders know. Long options, such as long calls, have limited risk. The purchase price is the risk on the position. One of the many reasons traders love options so much is that they are usually far cheaper than buying 100 or fewer shares of stock. But sometimes even options can be quite expensive, so a trader may consider a spread, such as a bull call or bear put spread. Besides a potentially cheaper trade with less overall risk, there can be other benefits as well.[more]

Timing Reversals Using Stochastics

John Seguin, Market Taker Mentoring

There is a myth that Stochastics and RSI (Relative Strength Index) are both used to determine whether a market has reached overbought/oversold status, thus indicating when a trend is near an end or likely to reverse direction. However, RSI is more appropriate for gauging strength of trend. An RSI reading above 50 indicates bullish momentum, and a reading below typically favors short positions. A Stochastic, meanwhile, is a more reliable indicator for timing market turns or reversals. [more]

Successful Option Trading Is Not Easy

John Kmiecik, Market Taker Mentoring

As a young retail option trader, one of the first things I did was buy an options program called “Options Made Easy.” Some of you may remember it from back in the day. It had three sets of red, yellow and green lights to guide you as an option trader. On the surface, it seemed easy. But in reality, option trading is far from easy. [more]

A Pragmatic Approach to Trading

John Seguin, Market Taker Mentoring

I practice and preach a “pragmatic approach” to trading. A technical trader gathers data, extracts facts and through back testing and empirical study applies the optimal trading strategy. The facts are extracted from price action. Traders and analysts mainly use open, high, low, close to determine momentum (direction), value, risk and profit targets. [more]

Covered Calls Can Work Wonders

John Kmiecik, Market Taker Mentoring

There is almost nothing more frustrating for an investor than to see an investment trade sideways. Granted, it is better than the stock moving lower, but it can still be disappointing. As an investor with no knowledge of options, you have two options: hold or sell. Take a look at the example of Boeing Co. (BA) below. Essentially, the stock has traded pretty much sideways since the beginning of 2023. [more]

Use ATR to Project Profit and Manage Risk

John Seguin, Market Taker Mentoring

Professional traders rely on a mix of mathematics, fundamentals and logic to design strategies, and they have research departments and economists to guide them as well. Fundamentals move markets, but when the fundamentals are lacking traders rely on their technical tools. [more]

Have You Written Your Trading Plan?

John Kmiecik, Market Taker Mentoring

On a recent Saturday morning, I did a webinar on the psychological aspects of trading. Without a doubt, trading psychology is my favorite topic to discuss, and in my opinion it’s the most important by a mile. It is a topic most traders realize needs to be addressed but usually do not want to think about. That’s because during the conversation the importance of a trading plan will be stressed. [more]

Technical Tools to Fit Your Trading Style

John Seguin, Market Taker Mentoring

All technical tools and indicators perform at times, but none pay off all the time. The secret to technical analysis is to identify which indicator is appropriate given current market conditions. I have researched many charting techniques, indicators and technical tools in my 30-plus years in the commodity and stock markets. Whenever I come across a setup or pattern that consistently leads to profitable trades, I place it in my journal. This “toolbox” is a collection of my favorite and most reliable indicators from many disciplines. Trial and error facilitated my journey to creating a personal technical style. I categorize the signals into three types of setups: directional, consolidation (neutral) and breakout. The combination of candlesticks and average true range (ATR) as a speed gauge is the most logical tool to begin creating strategies. [more]

Trading Options After Gaps Can Be Difficult

John Kmiecik, Market Taker Mentoring

This market remains a volatile beast, gapping higher or lower practically every session. We are also almost through another round of quarterly earnings, which always seem to create potential for large gaps. I think many of us can agree that the first 30 minutes of the market can be very volatile because of a volatility event or from an earnings report. If you have been watching the market over the past couple of months, you might say the entire sessions have been volatile. But by being patient, and many times sitting out early market action, you can improve your chances for success later in the session. [more]

Panic Adds Pace to Market Movement

John Seguin, Market Taker Mentoring

Raging inflation and more recently bank failures have added considerable volatility to many markets. There have been big swings in interest rates, which have a direct influence on equity indexes, currencies, precious metals and many commodities. Surprise events often bring on panic, which adds pace to market movement. [more]

A Good Old-Fashioned Bull Call

John Kmiecik, Market Taker Mentoring

No one likes a good old fashioned more than me, but cocktails are not what we are talking about here. Sometimes as option traders we try to get too fancy, and we get caught up in high-probability trade scenarios like out-of-the-money credit spreads. But many times, a bullish or bearish setup warrants a vertical debit spread. Let’s look at a recent example from MTM’s Group Coaching class. [more]

How to Trade Volume Voids

John Seguin, Market Taker Mentoring

As a futures broker, I had many clients who used black boxes for trading signals. These automated trading systems are mainly developed to capture vertical moves. When a buy/sell signal triggers it frequently has a domino effect, which causes prices to move rapidly. The most common bullish breakouts occur when the top of a channel (flag) or pennant (triangle) is violated. A bearish trend often begins when the bottom of a flag or pennant is breached. The type of candlestick at the onset of a breakout can be revealing as well. Candles with full bodies and small wicks indicate power. Thus, a full-bodied [more]

Improve Results with Profit Taking Orders

John Kmiecik, Market Taker Mentoring

There is a lot of subjectivity in life and in options trading. In both, there are lots of choices with many potential scenarios. As any trader knows, there are also lots of judgment calls and not a lot of certainty when it comes to options. There is, however, one move that can 100% improve your trading results. [more]

Which Trade Indicators Pair the Best?

John Seguin, Market Taker Mentoring

There are many tools and indicators for traders. None are infallible, yet they all have strengths under certain conditions. One indicator may give a reliable directional signal, but that signal becomes stronger if the strategy has a partner indicator that confirms the buy/sell or neutral signal. [more]

Some Bearish Setups Are Bullish

John Kmiecik, Market Taker Mentoring

I often remind traders that not every bullish setup that fails is bearish and not every bearish setup that fails is bullish. Then again, sometimes they are. Here are a couple of recent patterns we looked at in MTM’s Group Coaching class with one proving this theory. The jury was still out on the other one at the time of this writing. [more]

Tools of the Trade

John Seguin, Market Taker Mentoring

No matter which career you choose, they all require tools to be successful. Most tools are tangible, but others are psychological, mathematical and even spiritual. As a trader my tangible tool is a chart. There is math in my favorite market indicators, and the indicators illustrate psychological and sociological behavior. [more]

Meet Your New Best Friend

John Kmiecik, Market Taker Mentoring

If you follow me in MTM’s Group Coaching class, you know I start almost every session by explaining what I do when there are higher highs and higher lows and vice versa. I say it for a couple of reasons. One is that you need sayings drilled into your head, and the other is to remind you to follow the trend more times than not. [more]

Recession Fears Take Center Stage

John Seguin, Market Taker Mentoring

I make it a point during every MTM Monday Morning Meeting to highlight the connection between the markets that move money. Central banks set interest rates that have a direct impact on bond prices and currencies. Foreign exchange rates influence stocks, metals and energy, as well as many other commodities. A mixture of all these markets and earnings completes the chain of major market movements. For the past couple of years, prices or inflation figures have had the most impact on direction. However, there may have been a fundamental shift this past week. [more]

History Helps Determine Support and Resistance

John Seguin, Market Taker Mentoring

All traders strive to buy when prices are cheap and sell when they are rich. Bulls/buyers play the long side and search for support areas; bears/shorts favor the sell side and seek resistance areas. The choice to be a bull or bear varies for all traders. To determine support and resistance zones history helps. An ideal trade occurs when we catch a trend early and exit when it is exhausted. Traders endeavor to sell at a premium and buy when prices are cheap. Perfect entry and exit are desired, however rarely reality. [more]

Using ATRs to Set Profit Targets and Define Risk

John Seguin, Market Taker Mentoring

Around year’s end when the markets are generally quiet, I do some statistical analysis to prepare for the New Year. There is one spreadsheet of vital statistics I generate and use daily. It consists of recent average ranges and benchmark ranges for stocks, ETFs and commodities. Most charting platforms have the ATR (Average True Range) indicator. ATRs are valuable because they improve our ability to set profit targets and define risk over various time frames. Furthermore, a comparison of near- and long-term benchmarks can be used to determine if volatility is rich or cheap. [more]

Take a Trading Break for the Holidays

John Kmiecik, Market Taker Mentoring

The holidays are crazy for most people, and some might say the market is crazy right now as well. Whether or not you think the latter is true, the one thing that is for sure is you sometimes need to take a break trading. The holidays are a perfect time. [more]

Improve Your Trade Location

John Seguin, Market Taker Mentoring

One of the more difficult issues traders face is choosing the best prices for entry and exit. Good trade location simply means buying near the low of a move or selling when a rally reaches exhaustion. Identifying the onset of a trend and entering early in the cycle is another form of good location. The earlier you catch a trend risk is mitigated while profit potential increases. Pinpointing daily entry and exit levels, also known as support and resistance areas, requires some technical and fundamental history of the market you are trading. [more]

Don’t Forget About Iron Condors

John Kmiecik, Market Taker Mentoring

A short iron condor is a market-neutral strategy that combines two credit spreads. A call credit spread is implemented above the current stock price, and a put credit spread is implemented below. The objective of any credit spread is to profit from the short options’ time decay while protecting the position with further out-of-the-money long options.

It’s a Theta Trade

The option greek that makes the biggest impact on a short iron condor is theta. The iron condor is simply combining both the call and put credit spreads into one trade. The trade has two forms of [more]

Option IV Levels Are Important But ...

John Kmiecik, Market Taker Mentoring

Let’s get this out in the open right away. Implied volatility is very important for an option trader. Let me repeat that. IV levels are important. However, many option traders will place the importance of IV levels above that of the expected move or non-move of the underlying. To me, this is a big mistake.

Changing Your Thought Process

I have so many students who get caught up in this thought process. When IV is elevated, they think the only option position to consider is selling premium. Of course, when IV levels are lower, it’s time to buy options. Now don’t get me wrong, I am not saying to go out of your way to sell cheap premium and buy expensive premium. But what matters more? For example, if I am selling a call credit ... [ more ]

Set Your Rules for the Tools of Trading

John Seguin, Market Mentor Mentoring

Over the past 30 years, I have researched and tested many strategies using the seemingly countless tools and indicators available to traders. My goal has always been to understand the logic of each technical tool, as well as to learn the fundamentals that affect any futures market including indexes. Each tool has a purpose, but they all have weaknesses as well.

Generally, the tools of trading are designed to reveal trend strength, change in trend, timing entry, and risk and profit targets. One of my rules for tools is to have one indicator for each type of market condition or situation. There are short-term indicators for timing breakouts or reversals. And, of course, there are 50- and 200-day moving averages... [more]

Trust Resistance Over Your Gut

John Kmiecik, Market Taker Mentoring

One recent morning in MTM’s group coaching class, we observed the S&P 500 ETF (SPY) gapping up to a previous resistance level. As I often remind traders who follow technical analysis, resistance like support has a much better chance of not letting the underlying through that level. I like to say there is about a 70% chance it will hold. So, I asked the traders in group coaching class, what has a better chance of happening after the gap higher? [more]

Choosing Moving Averages Based on Trading Time Frame

John Seguin, Market Taker Mentoring

Futures traders tend to be more short-term oriented than stock and ETF traders. Most of my trades in the futures market are intended to be speculative, meaning I will be out the position within 24 hours or even by the end of the trading session. Generally, stock market traders and investors plan to hang onto trades for more than a day and often for weeks or longer. Thus, it is important to choose technical indicators that are pertinent to your time frame. [more]

Stop Always Thinking Bullish Trades

John Kmiecik, Market Taker Mentoring

Here is a quick but important post about remembering what type of market we are facing and why many traders always think about bullish trades…even when the market is heading south. Let’s face it, it has been a less than stellar bullish year thus far. That said, many traders are still primarily looking for bullish trades. Let’s consider why this may be the case.

Ingrained to Be Bullish

One of the first things I always ask traders when talking about trades, especially in a bullish...[more]

Define Risk and Lock in Profits with Stops

John Seguin, Market Taker Mentoring

A trader’s goal is to enter a position early in a trend and ride that position until an objective or target price is met. Catching a trend is difficult enough; squeezing the last dollar out of a trade is even harder. Stop loss orders are used to set risk. As another option they can be used to manage profitable trades with an order type known as a “trailing stop.”

Setting a Stop Loss

Once a position is taken, the next step is to set a stop loss price. When a stop loss order is triggered, it becomes a market order. [more]

SPY Double-Bottom Was No Surprise

John Kmiecik, Market Taker Mentoring

The S&P 500 ETF (SPY) as well as the index itself moved higher last week, surprising more than a few traders and investors. But if you were watching the technical analysis closely, it should not have come as a shock to you. Lat’s take a look.

SPY at Support

In the chart of SPY below, you can see the ETF had previously come down to around the $362 level in mid-June. On Friday, Sept. 30, the ETF closed below that level. But what happened the following Monday should not have been a surprise. [ more ]

How to Think Like a Trading Pro

John Seguin, Market Taker Mentoring

I spent almost 20 years at the trading exchanges in Chicago and another 20 years writing newsletters, building trading systems and educating traders. As a broker I serviced numerous professional traders. Some used only fundamental data, economic reports or order flow to make decisions. Some used charts and technical indicators, while others entered trades because an automated system or “black box” gave the signal to buy or sell. Some traders incorporated many disciplines into their decision making. But they all were seeking answers to the right questions. [ more ]

An Options Trading Routine Is Smart

John Kmiecik, Market Taker Mentoring

I often harp on traders to have a written trading plan. Without one, in my opinion, they won’t have much chance of being successful in the long run. One of the many reasons to consider a trading plan is to formulate a routine for yourself. Following a routine you are comfortable and successful with is imperative to your potential success.[more]

Prepare for Panic and Learn

John Seguin, Market Taker Mentoring

The U.S Department of Labor releases the employment report on the first Friday of each month. For many years it was the most critical and scrutinized of all the monthly economic reports. If the actual results varied from the consensus estimates panic often ensued. The impact of this report frequently set the direction for weeks and sometimes an entire month. [more]

Use Positive Theta to Offset Delta Risk

John Kmiecik, Market Taker Mentoring

If you know anything about me, it’s probably my profound love for time spreads, particularly long calendars. Long calendars consist of selling a call or put and buying another call or put with the same strike but a longer expiration. For me that usually means selling the current week’s expiration and buying the next if there are weekly options available. Positive theta is the main source of potential income for the position, but I like to look at it maybe a little differently. Let me explain. [more]

Make Publishing Your Game Plan a Priority

John Seguin, Market Taker Mentoring

A few decades back I began publishing daily newsletters for traders both on and off the trading floor of the CBOT. When I started this practice, I focused on interest rate markets because I was a broker in the 30-year bond arena. I prioritized and listed all the elements a trader requires to make sound trading decisions. I was fortunate enough to start my career in a sector that affected many other financial markets such as foreign exchange, precious metal, equity index, energy and even agriculture. [more]

Support and Resistance Are Your Edge

John Kmiecik, Market Taker Mentoring

Over the past several months, this market has been tough to navigate as a swing trader, in my opinion and based on discussions with other traders. But despite so-called difficult market conditions, traders can always look for an edge, and that edge can be support and resistance. [more]

How to Identify Market Extremes

John Seguin, Market Taker Mentoring

One of the more difficult tasks traders face is choosing areas where extremes (high or low) are likely to form. Pinpointing ideal entry and exit levels is possibly the most difficult and desired task we face. In the industry, buy areas are known as support and sell zones are called resistance areas. To enhance your ability to identify... [more]

Option Management Is Key

John Kmiecik, Market Taker Mentoring

Consider this a friendly reminder about managing your option trades. With the craziness and the volatility of the market over the past few months, I have gotten multiple questions during MTM’s group coaching class and especially through email about managing trades. For the most part, the trades in question are losing ones. I always tell these traders the same thing: Know exactly what you will do, no matter what happens, before entering any trade. [more]

Technical Overload: Keep It Simple

John Seguin, Market Mentor Mentoring

No tool or indicator performs well in all market conditions. The plethora of indicators/tools have merit, yet they all have faults. Thus, it is imperative that each of your indicators have a purpose. They should reveal solutions for a variety of market conditions. Necessary indicators: bull, bear, neutral, reversal, speed and resistance/support.

An overload of indicators leads to conflict, and confidence is lost when conflict reigns. Trading is challenging enough, so we must utilize tools that serve a specific purpose. ... [more]

Understanding the Nuances of Option Delta

John Kmiecik, Market Taker Mentoring

There are so many facets to options trading compared with stock and futures trading. Getting a good grip on the option greeks is mandatory to truly understanding how options function. For option traders both new and experienced, knowing what option delta is and what it means for your option position can be the difference between a profitable and not so profitable position. Before we go further, let’s look at the definition of option delta.

Different Definitions of Option Delta

Here are four definitions... [more]

Essential Technical Tools for Trading

John Seguin, Market Taker Mentoring

When I purchased my first house, I had no tools to repair or build anything. I was far from a handyman and my father knew it. After we settled in, my dad showed up with gifts that every homeowner should have. Those essential tools were duct tape, WD40, a couple of screwdrivers, plyers, electric drill and a hammer. He said I could fix most problems and build shelves with these essential tools. As time passed my toolbox grew, but after 30-plus years of home ownership I still use those original tools more than any others.

Every trader I worked with or for had a “toolbox.” The tools of the trade are either fundamental (forces of supply and demand) or technical (charts and indicators). [more]

The Basics of Implied Volatility and Options

John Kmiecik, Market Taker Mentoring

Implied volatility (IV) represents the expected volatility of the underlying (usually stock) over the life of an option. As the expectations of the underlying changes, so does the option premium. This is influenced by the basics of supply and demand. Naturally, other factors can change the premium, like the underlying’s movement and time, but here we will focus solely on IV. [more]

How to Read Big Player Trader Patterns

John Seguin, Market Taker Mentoring

As an educator I have made assumptions that new traders already have a good understanding of market fundamentals. The more I teach the more I realize most traders have not experienced trading pits and the valuable lessons we were privy to in that environment. Looking back, it was a privilege to watch the auction process in its most basic form: a trading pit. [more]

Tighten the Leash on Your Option Trades

John Kmiecik, Market Taker Mentoring

It’s been difficult to profit with swing trades (generally 2- to 5-day trades) as of late because of the extreme market volatility. The market swings have been big and many times very unpredictable on a day-to-day basis. Under these circumstances, , it might be prudent for option traders to take profits and cut losses quicker than normal. This includes moving up hard and mental stops. [more]

Gauging a Trend Too Far, Too Fast

John Seguin, Market Taker Mentoring

All traders endeavor to catch a trend early and ride it to the end. To accomplish that requires incredible timing on both entry and exit. Some trends end slowly after shifting to neutral. Others end abruptly after moving too far, too fast, otherwise known as reaching overbought/oversold (OB/OS) status. [more]

Long Puts Are a Viable Option

John Kmiecik, Market Taker Mentoring

Let this be a reminder to all option traders who have abandoned buying calls and puts: Don’t forget to consider them an option. Long calls and puts were the first trading strategies I learned as a brand-new retail option trader, but most option traders I’ve encountered over the years tend to forget about them. In a market like the one we have experienced over the past several months, however, wouldn’t a long put be a more than viable option? [more]

Practical Uses for Average True Range

John Seguin, Market Taker Mentoring

Average True Range (ATR) is one of the most practical indicators and can be used in many ways. Some of the ways I employ ATR is to compare recent ranges with longer-term or benchmark averages. In this way I can judge whether current volatility is high or low. Spreads tend to pay off when current ATRs are lower than the long-term ones. [more]

Don't Be a Cocky Trader

John Kmiecik, Market Taker Mentoring

It has been a crazy couple of years if you have not noticed. The world we live in is not the same anymore nor will it ever be for better or for worse. More than ever, we as humans need to take a break and try to get away and get our minds off stressful aspects of our lives, which includes options trading.

Taking a break can be one of the best things that you can ever do to help improve your trading. Writing a trading plan will always be the most important in my eyes, but taking a break from time to time is up there as well. The stress that can be caused from trading can really affect other aspects of your life that do not involve trading. I remember having several awful days of trading when I was still [more]

What Do You Know About Option Theta?

John Kmiecik, Market Taker Mentoring

What do you know about option theta? For many, it can be the easiest option greek to understand, but for many others it is the most difficult. Let’s take a quick look below and, let’s hope, clear up some confusion.

Theta measures the rate of decline in the value of an option due to time passing. Keeping it simple, for every day that passes, theta should decrease the option’s premium by the amount of theta. Long options, both calls and puts, have negative theta. Short options, both calls and puts, have positive theta. How can we use this as part of our option trading? Theta is also highest at-the-money (ATM) and smaller out-of-the-money (OTM) and in-the-money (ITM). [more]

Improve Timing When Entering a Position

John Seguin, Market Taker Mentoring

Late entry for a position can be costly in that it increases risk and decreases profit potential. In previous articles I introduced some of the tools from my “trader toolbox.” In this piece I will introduce some of my favorite indicators for initiating a bullish or bearish position in a timely fashion.

To improve timing when entering a position, I prefer using 60-minute bar or candlestick charts. Liquidity (volume) peaks during the opening 60 minutes of the trading day and the last 30 minutes of the session. Professional traders tend to be most active during those times because they can execute large orders without hurting their positions. Fundamentals move markets and pro traders [more]

Understanding Risk and How to Reduce It

John Kmiecik, Market Taker Mentoring

There is no sure thing as an option trader when it comes to risk and profits. Heck, there are not many things in life in general that are a sure bet either, no matter how much the odds may be on your side. All trading is speculative, but as traders we do our best to improve the odds. But what if there is not a setup that matches our criteria for entry?

I like to call it the “ducks in a row” theory. As a quick example, what if you have a bullish setup, a bullish trigger and a bullish market? That could be considered a ducks-in-a-row trade. But what if your ducks are not in a row? The simple answer is, do not take the trade. But what if your gut is telling you something else? [more]

Organizing Prices to Identify Patterns

John Seguin, Market Taker Mentoring

Before computers were used for charting on the CBOT trading floor, books were published weekly that had day and week bar charts for all the futures markets. On the exchange trading floor, many traders used handmade graphs to track short-term price action with intraday bars using open, high, low, close (OHLC). Some used the point & figure technique and eventually candlesticks became popular. Charting or technical analysis is mapping and organizing prices to identify patterns.

Numerous books have been written on seemingly countless patterns. There is terminology to describe popular patterns using the bar or point & figure style, such as flags and pennants, trendlines, head & shoulders, gaps, island reversals, and triangles to name a few. [more]

Most Option Traders Roll Strikes Too Soon

John Kmiecik, Market Taker Mentoring

There is a common issue I see all the time with traders who use options with their investments, particularly when covered calls and time spreads are involved. The problem is they tend roll the short position too soon when the short strike is being threatened. I talk about this frequently in MTM’s Group Coaching class and show many examples. Let’s look at one below.

Selling Premium

Selling a call option against a stock position is commonly done by investors (covered call). The call option’s strike is generally sold where the investor thinks the stock [more]

A Warning About Selling Naked Puts

John Kmiecik, Market Taker Mentoring

With another wave of earnings right around the corner, I feel the need to caution option traders and investors about selling “naked” or cash-secured puts over an earnings announcement. Whether you refer to it as writing or selling naked options, many option traders do not understand the risk. Selling a put option without having a position in the underlying stock or being long any options on the stock is considered a naked position. For example, if a trader is writing naked calls, he is selling calls without owning the stock. If the trader did own the stock, the position would be considered covered.

Your Checklist Before Entering a Trade

John Seguin, Market Taker Mentoring

Growing up I was passionate about sports; baseball was my favorite. I loved the game and practice. I never had enough ground balls, fly balls, pitching and batting. My obsession to be the best was not a chore, it was fun. I have taken that passion and applied it to markets. If you want to be a pro, practice like one. Practice builds instinct.

Aside from being a Market Taker mentor, I publish daily newsletters to guide traders in the futures markets. I started doing this in the late ’80s as a broker, and to be competitive I had to adapt to different conditions and client requests. It forced me to develop strategies for equities, treasuries, precious metals, energies, currencies and even grains. I started my analytic career as a technician and soon [more]

How to Trade Low Volume Pockets

John Seguin, Market Taker Mentoring

Most trading systems are developed to capture vertical moves. The most common bullish breakouts occur when the top of a channel (flag) or pennant (triangle) is violated. A bearish trend often begins when the bottom of a flag or pennant is breached. The type of candlestick at the onset of a breakout can be revealing as well. Candles with full bodies and small wicks are an indication of power. Thus, a full-bodied candle passing through a trendline is a great indicator for an upcoming above average vertical move. When a market breaks into a trend it is often fast and furious leaving behind low volume pockets. [more]

Using Candlesticks to Catch Trends

John Seguin, Market Taker Mentoring

All technical tools and indicators have strengths, but it may be more important to understand their weaknesses. The trick to using technical tools is to identify a pattern or indicator that commonly precedes a high percentage trade. I have studied many charting techniques and tools in my 30-plus years in the commodity markets. Whenever I come across a pattern that has consistently led to a payoff, I enter it in my toolbox or journal. I have a section called “candle confidence,” which are patterns that fit my personal technical style. I categorized the signals into three types of setups: directional, consolidation and breakout. [more]

2 Crucial Option Trading Mantras

John Kmiecik, Market Taker Mentoring

Are you a person who likes to repeat yourself? If you are, this lesson will be an easy one. If you are in my group coaching class or a one-on-one student, you have heard me repeat some of my favorite phrases that have helped me become successful. Why do I repeat them so frequently? I want my students to know how important these mantras are, and I want them to hear my voice when the situation arises and think about what they need to do or consider.

Let’s be clear, I don’t get a thrill out of haunting your thoughts, but I do get a thrill out of you knowing what I feel is very important to your potential success. I am just going to cover two mantras here, and I will explain briefly the meaning behind them. [more]

Enhance Trade Timing with Intraday Direction Indicators

John Seguin, Market Taker Mentoring

Perfect timing for entering and exiting trades is high on the wish list of every good trader. Early identification of a breakout or trend is known as good trade location. Ideal entry not only increases profit potential, but it also reduces risk. It is important to have short-term or intraday direction indicators that will enhance the timing of a trade.

Pre-trend Phases

There are certain patterns that frequently occur before a trend begins and when one is near exhaustion. Maybe the most prevalent pre-breakout pattern is known as a consolidation phase. Trend potential is high when day ranges and volume dip below average for [more]

Trading Lower Highs and Lower Lows

John Kmiecik, Market Taker Mentoring

The market has made some big moves lower as of late and at some point, if not by the time this article is published, it will move higher again. I assume you have heard the saying “the trend is your friend.” Probably too many times, right? Well, there are several sayings and reminders when it comes to trading that stand the test of time and this is absolutely one of them. I like to start out MTM’s Group Coaching sessions by reminding traders to consider the trend that will put the odds on their side for a potentially successful trade.

As technical analysts and traders, we are always looking for an edge and to put the odds on our side. Finding an opportunity like a trend fits these criteria. An uptrend is an underlying that is setting higher pivot highs and higher pivot lows as seen below. [more]

Using Average True Range to Identify Trade Type

John Seguin, Market Taker Mentoring

At least once a quarter I make it a point to collect statistical data that will be used for choosing trade type as well as setting targets and risk. This vital information is stored in a spreadsheet, and one of the features consists of recent average true ranges (ATR) compared with benchmark or long-term ATRs for stocks, ETFs and commodities.

Use ATR to Determine Markets Phases

All charting platforms have an indicator that tracks average ranges. ATRs are valuable because they improve our ability to set profit targets and define risk over various time frames. Furthermore, a comparison of near- and long-term benchmarks can be used to [more]

Option Traders Need to Consider Spreads

John Kmiecik, Market Taker Mentoring

If you learned about options the way I did, you started with long calls and puts. I was fascinated that I could have a directional bias for the underlying and make money with options with considerably less risk than buying or selling shares. But as you progress as an option trader, you learn there may be different and better ways to do so than just buying a call or put. As always with options, there are trade-offs too.

For example, let’s say an option trader believes XYZ stock will rally over the next few weeks. The stock is currently trading at $59.50. He could buy the February 60 call for 3.50. But what if XYZ traded sideways or dropped in price over the next several weeks or the [more]

Identify Neutrality for Trend Reversals

John Seguin, Market Taker Mentoring

Markets tend to shift to neutral at the end of trends. Furthermore, there are often subtle changes in momentum before reversing direction. Good traders have a knack for identifying the start of a trend or the end of one. There are a few patterns that are common at the end of a move.

Subtle Changes Reveal a Shift in Bias

During a bullish trend it is common to see the low of the day within the first hour of the session. And in a bear market the daily high is often made in the first 60 minutes. When opposite activity occurs, it signals a subtle shift in bias. When a trend higher swings to [more]

What Does a Bullish Base Look Like?

John Kmiecik, Market Taker Mentoring

I talk about bullish bases in MTM’s Group Coaching class practically every day, especially with the market generally moving higher for most of 2021. Yes, the market has been predominantly bullish. But what does a bullish base look like and how can we use it for a potential bullish entry? Let’s take a look.

What I consider to be a bullish base is when a stock moves considerably higher, usually over a short period of time, and then begins to trade sideways. To me, the question becomes what is sideways? If the stock does not pull back more than two-thirds of the move higher, it is a bullish base. [more]

Confirm Market Turns Using Stochastics

John Seguin, Market Taker Mentoring

The myth is that Stochastics and RSI (Relative Strength Index) are both used to determine whether a market has reached overbought/oversold status, thus indicating when a trend is near an end or likely to reverse direction. However, RSI is more appropriate for gauging strength of trend. An RSI reading above 50 indicates bullish momentum and a reading below typically favors short positions, while a Stochastic is a more reliable indicator for identifying market turns.