Keeping the Context When Trading Patterns

Myopia and trading, generally, do not mix well. What do I mean? Focusing on a single timeframe while looking for an opportunity will likely have the trader entering many subpar trades that look like wonderful candidates without the markets background. I say generally, because some HFT algorithms and other unique trading methodologies are indeed very short term focused. However, I am referring to strategic trading even if that means a daily timeframe focus. Having a plan and carving out trading opportunities requires time, work and analysis.

A popular and relatively simple trading pattern is based on continuation. Continuation is defined for our purpose, as market movement in the direction of the most recent action. Detecting movement that is likely to produce continuation can be trickier than it may sound. Indeed, just any directional move will not suffice. What we want to detect is areas and conditions where an order imbalance occurs. Finding points where a large enough imbalance happened can be done visually or with the aid of technical studies or even volume. These order imbalances should create sharp movements as compared to the recent action preceding it.

The set-up or theory behind the trade is that the imbalance that created the spike in prices may have residual reverberations. Trades taking quick profits can pause the action or turn it against the run up or down. Traders who wanted to either take losses or participate in the new direction and missed out, may be waiting to time their trades. The fresh order flow precipitates a retest or possible new leg in the direction of the original impulse.

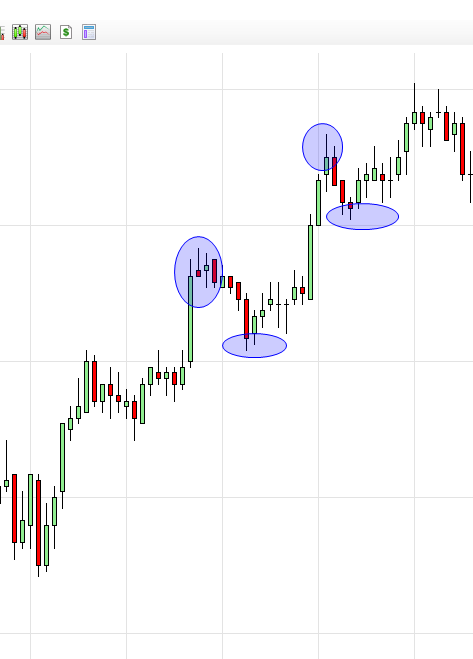

Below is an example of two easy to spot continuation trade opportunities. The push up leads to a brief pause while the market digested the impulse, then new order flow propelled prices onward.

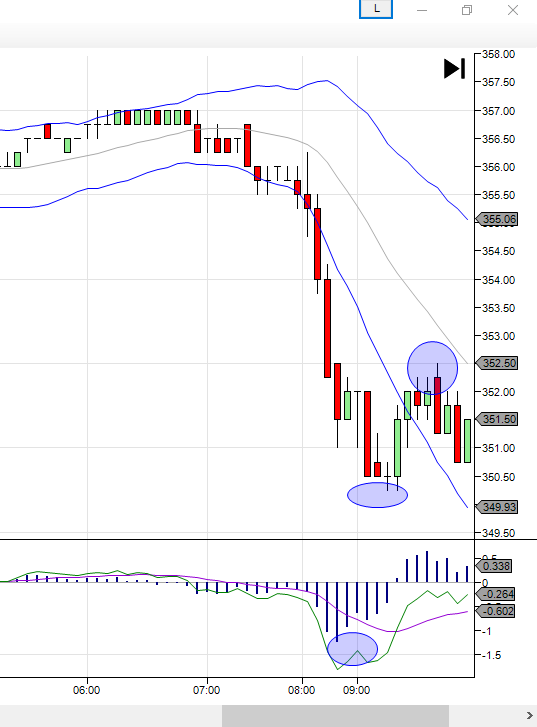

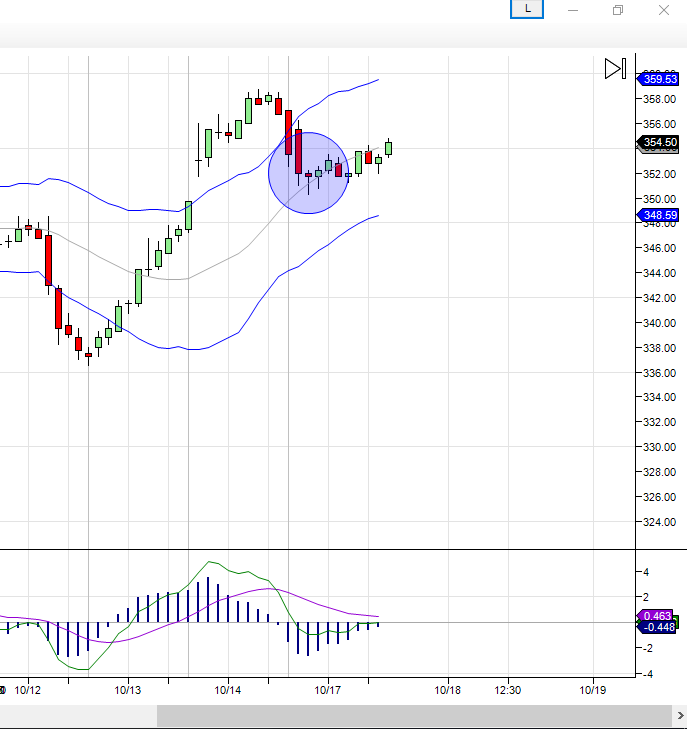

One reason for the apparent success of these trades is the clear path upwards. For the trade to be sound, no clear support or resistance should be in the way of the projected move. Examples of set-ups without a clear path to movement are below. The first chart is five-minute corn futures. It looks as though there is a chance for a retest down

However, when viewed with the proper context, it becomes clear that support may come at the EMA (Exponential Moving Average). The next higher timeframe has a continuation pattern of its own. In this situation, the higher timeframe is likely to dominate the order flow and render the short term irrelevant. Indeed, trading the failure of the shorter term continuation pattern back into the longer term provides a nice entry for going the other direction.

The moral of the story is look for areas just above or below current market action that may bring in order flow on another timeframe opposite of your set-up. Traders should consider avoiding trading on one timeframe and taking a myopic view. Be sure the market has room to run in the desired direction. Carving out trades correctly, should up your batting average.

Craig Garbie, Market Taker Mentoring, Inc.