Trading and Filtering Continuation Trades

The last article I talked about the importance of considering the context of the market when carving out trades and ideas. In this piece, I will explore some contextual elements that can be used as filters for continuation trades. Continuation trades are defined as trade opportunities in the direction of the perceived trend on the time frame being traded. Pauses or small retracements in the directional price action, provide opportunities to participate in the directional activity.

The question remains, under what conditions will a high probability trade present itself? The first thing to look for is where an impulse has taken place. An impulse is a sharp move in the prices on the time frame being traded. Generally, a trader will want to see the move greater than the normal rotations in their market. The impulse implies an order imbalance. As traders, we make our way being on the right side of order imbalances. Presumably a trade can be made taking advantage of the condition set forth.

One way to detect whether or not the price has moved in an impulsive manner is to use a technical study like a price oscillator. Technical studies can aid in the objectivity of our observations. Our unsubstantiated biases can have us seeing conditions that do not actually exist.

Using a price oscillator can help the process of seeking out more reliable patterns.

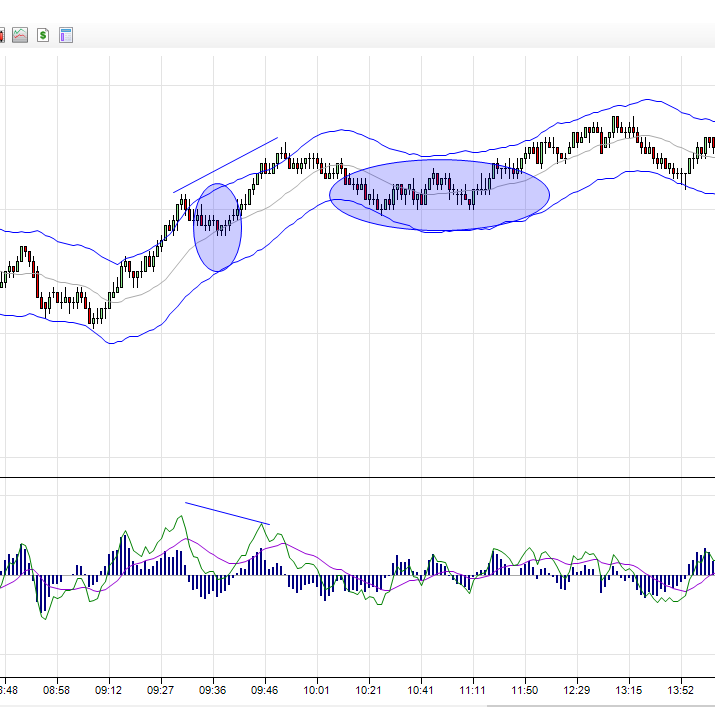

As seen in the above example chart, momentum gauged by the price oscillator lead to shallow retracements at somewhat predictable intervals. The last example to the far right, the oscillator did not signal new momentum highs. The price made new highs but the oscillator did not. What resulted was a deeper retracement than the previous action. Divergence of price and momentum does not imply a change in trend, only a possible deeper retracement or consolidation.

If one combines momentum identified by the price oscillator with a push outside of the bands; in this case Keltner Channels, we have filtered for reliable price pulses.

Both momentum lows or highs coupled with price action outside the channels, combines for a relatively high probability trade.

The last piece of the puzzle is to add a trend strength indicator. Seeking out continuation trades only in strong trending markets as identified with a reliable indicator, will segregate the best conditions. The ADX, or Average Directional Indicator, is a good tool to gauge the trendiness of a market. It is a measure of price bar overlap and does a fine job identifying conditions suitable for continuation. Most charting platforms have the indicator in their arsenal. The default time frame is fourteen periods. Consider staying with that setting or whatever setting works for you.

For my purposes, I like to see the indicator above at least 25 and rising for the trend to be considered strong or strengthening.

All the elements are brought together in the above example. An impulse is identified using a price oscillator, prices are pushed outside the Keltners, and the trend is identified as being strong.

Using filters will cut down on trade frequency but the win to loss ratio may increase creating an overall confidence which could lead to profitability.

Craig Garbie, Market Taker Mentoring, Inc.