Define Support and Resistance Zones

All traders strive to buy when prices are cheap and sell when they are rich. Bulls or buyers prefer the long side and search for support areas, while bears or sellers favor the short side and seek out resistance areas. The choice to be a bull or bear varies for all traders. To determine support and resistance zones traders use charts that reveal the history of price action. An ideal trade occurs when we enter a trend early and exit when it is exhausted. Buy low, sell high. Traders endeavor to sell as a trend is peaking and buy when prices are cheap. Ideal entry and exit are desired, but perfect timing is illusive.

Price Patterns

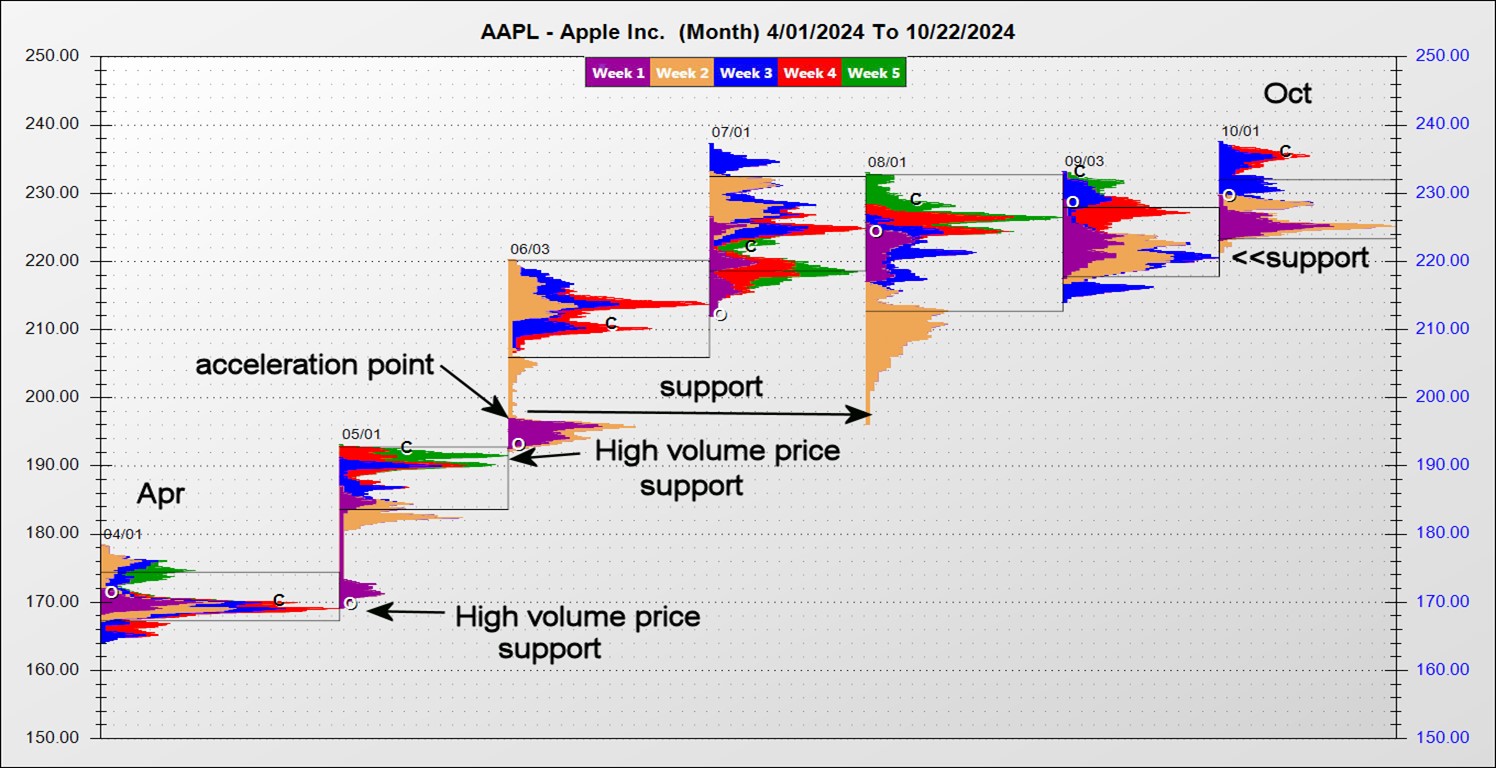

Identifying perfect trade location is one of the most difficult tasks for traders. To hone your ability to pick off extreme highs and lows of a trend, refer to recent history. Chart patterns repeat in all markets and time frames. Markets tend to stall and reverse after retesting previous high-volume areas. In graphs, high-volume zones frequently take the shape of triangles (pennants) and rectangles (flags). They are also known as congestion or consolidation zones. Therefore, we must identify a high-volume area. A reversal in direction frequently occurs when retesting previous acceleration points, so we must identify those as well.

High-Volume Zone Patterns

High-volume zones take shape before and after extraordinary vertical moves or trends. Volatility tends to decline while these consolidation patterns take shape. When a market retests the top of a previous flag formation, it often provides a support area. When price rises to retest the bottom of a flag or rectangle shape, it typically provides a resistance area. The pennant formation is triangular and usually has an apex. Apexes reveal high volume or fair prices that are usually solid support/resistance when retested. Train your eyes to identify these shapes. Your trade location will improve and subsequently so will profits if you use these patterns for entering and exiting positions. The charts below illustrate support/resistance zones.

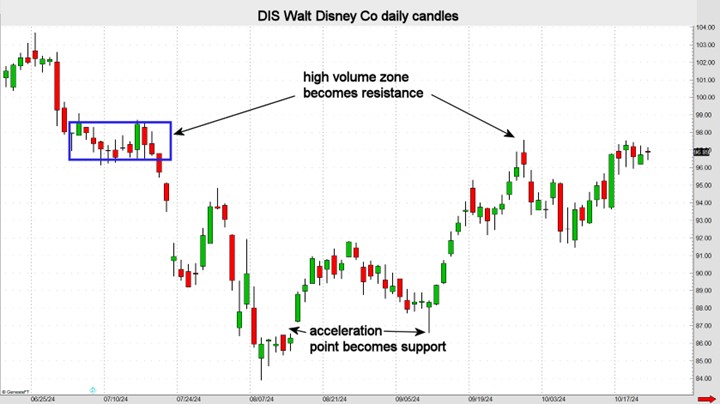

Acceleration Points and Gaps

An extreme (top or bottom) is often made when a market tests a previous acceleration point or a gap. Fundamental events frequently lead to a breakout of a congestion phase. Such moves are often violent with an increase in volume. Breakout candlesticks typically have a long body with small to no wicks. The charts below show how old acceleration points become support/resistance when revisited.

Double Tops and Bottoms

Support areas often form when a previous extreme low is tested. This is called a double bottom pattern. Conversely, a double top occurs when a previous high is retested. When a double bottom or top is retested, though rare, it sometimes turns into a triple bottom or top.

History Helps

When searching for optimal entry and exit levels, history can be a great help. Tracking old highs and lows as well congestion patterns (flags and pennants) is a good start. A little charting homework will improve trade location thus increasing profit potential while reducing risk.

John Seguin, Market Taker Mentoring